Predicting stock prices has long been a challenge for investors and analysts alike. With the advent of deep learning, particularly Long Short-Term Memory (LSTM) neural networks, we now have powerful tools to analyze time-series data like stock prices.

In this tutorial, we will walk through setting up an LSTM model on an Ubuntu 24.04 GPU server to predict stock prices, using Apple Inc. (AAPL) as an example.

Prerequisites

Before we begin, ensure you have:

- Ubuntu 24.04 server with GPU capabilities.

- Python 3 and NVIDIA drivers installed.

- Basic familiarity with terminal commands.

Step 1: Setting Up the Environment

First, let’s create a clean Python environment and install the necessary packages:

1. Install Python’s virtual environment and pip packages.

apt install python3-venv python3-pip2. Create a new virtual environment.

python3 -m venv stock_env3. Activate the environment.

source stock_env/bin/activate4. Install essential packages, including TensorFlow, for our LSTM model.

pip install tensorflow numpy pandas matplotlib scikit-learn yfinanceStep 2: Writing the LSTM Stock Prediction Script

Now, we will write the full Python script to download stock data, preprocess it, build and train the LSTM model, and visualize the predictions. This script handles everything: data download, training, evaluation, and next-day prediction.

Create the script file.

nano stock_prediction_lstm.pyAdd the following code.

import numpy as np

import pandas as pd

import yfinance as yf

import matplotlib.pyplot as plt

from sklearn.preprocessing import MinMaxScaler

from tensorflow.keras.models import Sequential

from tensorflow.keras.layers import LSTM, Dense, Dropout

# Download stock data directly

ticker = 'AAPL'

data = yf.download(ticker, start='2010-01-01', end='2025-04-20')

# Preprocess data

data_close = data[['Close']]

dataset = data_close.values

# Scale data between 0 and 1

scaler = MinMaxScaler(feature_range=(0, 1))

scaled_data = scaler.fit_transform(dataset)

# Split into training (80%) and testing (20%)

train_len = int(len(scaled_data) * 0.8)

train_data = scaled_data[:train_len]

# Function to create dataset for LSTM

def create_dataset(data, time_step=60):

X, y = [], []

for i in range(time_step, len(data)):

X.append(data[i-time_step:i, 0])

y.append(data[i, 0])

return np.array(X), np.array(y)

# Prepare training data

X_train, y_train = create_dataset(train_data)

X_train = X_train.reshape(X_train.shape[0], X_train.shape[1], 1)

# Build the LSTM model

model = Sequential([

LSTM(50, return_sequences=True, input_shape=(X_train.shape[1], 1)),

Dropout(0.2),

LSTM(50, return_sequences=False),

Dropout(0.2),

Dense(25),

Dense(1)

])

model.compile(optimizer='adam', loss='mean_squared_error')

# Train the model

model.fit(X_train, y_train, batch_size=32, epochs=50)

model.save('lstm_stock_model.h5')

# Prepare test data

test_data = scaled_data[train_len - 60:]

X_test, y_test = create_dataset(test_data)

X_test = X_test.reshape(X_test.shape[0], X_test.shape[1], 1)

# Predict and inverse transform

predictions = model.predict(X_test)

predictions = scaler.inverse_transform(predictions)

y_test_actual = scaler.inverse_transform(y_test.reshape(-1, 1))

# Calculate RMSE

rmse = np.sqrt(np.mean((predictions - y_test_actual)**2))

print(f"Root Mean Squared Error (RMSE): {rmse}")

# Visualization

train = data_close[:train_len]

valid = data_close[train_len:].copy()

valid['Predictions'] = predictions

plt.figure(figsize=(16, 8))

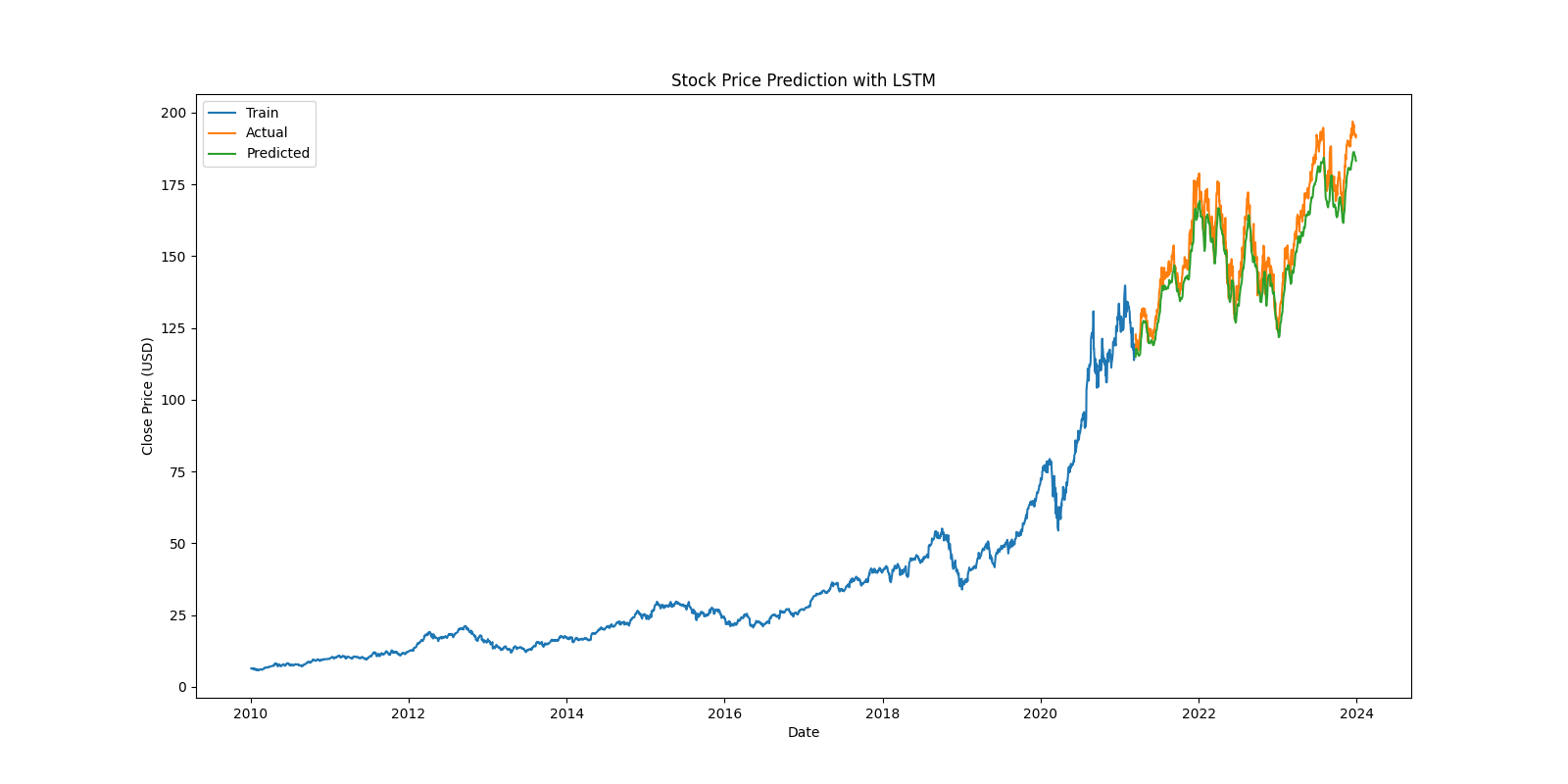

plt.title('Stock Price Prediction with LSTM')

plt.xlabel('Date')

plt.ylabel('Close Price (USD)')

plt.plot(train['Close'], label='Train')

plt.plot(valid['Close'], label='Actual')

plt.plot(valid['Predictions'], label='Predicted')

plt.legend()

plt.savefig('stock_prediction_plot.png')

plt.show()

# Predict the next day's closing price

def predict_next_day(model, data, scaler, time_step=60):

last_60_days = data[-time_step:].values

last_60_scaled = scaler.transform(last_60_days)

X_pred = np.array([last_60_scaled])

X_pred = X_pred.reshape(X_pred.shape[0], X_pred.shape[1], 1)

pred_price = model.predict(X_pred)

return scaler.inverse_transform(pred_price)[0][0]

next_day_price = predict_next_day(model, data_close, scaler)

print(f"Predicted next day price for {ticker}: ${next_day_price:.2f}")The above code:

- Downloads historical stock data for AAPL from Yahoo Finance.

- Trains an LSTM neural network to predict the future closing price based on past data.

- Visualizes the model’s predicted vs. actual closing prices.

- Predicts and displays the next day’s closing price for Apple’s stock.

Step 3: Run the Model

Now let’s run the script to train the model and see the results.

python3 stock_prediction_lstm.pyThis step executes the prediction workflow and shows model accuracy and forecast.

Root Mean Squared Error (RMSE): 7.07722469189058

1/1 ━━━━━━━━━━━━━━━━━━━━ 0s 25ms/step

Predicted next day price for AAPL: $182.96Step 4: Download the Prediction Chart

To visualize the chart on your local system, use scp to download it.

scp root@YOUR_SERVER_IP:/root/stock_prediction_plot.png Downloads/Conclusion

In this guide, you learned how to predict stock prices using an LSTM neural network on an Ubuntu 24.04 GPU server. We used Python and deep learning tools to download historical stock data, train a model, and predict the next day’s closing price for Apple’s stock. We also visualized the model’s performance and saved the results for easy access.