Payment security protects potentially the most important sensitive information that your eCommerce store handles on a daily basis—cardholder data.

For a hacker or fraudster, getting access to cardholder data is almost as good as winning the lottery. And with huge numbers of customers buying products online every day, the potential is enormous. Implementing payment security best practices mitigates the risks these cyberattacks pose to your eCommerce store.

The continuous rise of eCommerce threats and its risks

As the number of eCommerce businesses continues to grow, so do the threats that put them at risk.

Hackers grow more sophisticated by the day, executing hard-to-spot phishing attacks or convincing social engineering schemes. Malware and ransomware have grown exponentially, controlled by the evolving creativity of black-hat hackers. And employees have more access to data than ever before, increasing the risk of accidental—and not-so-accidental—internal data breaches.

It’s no wonder that the cost of a data breach is at an all-time high. It’s not just the immediate financial loss you must be concerned with, as the subsequent reputational and legal costs can cause long-term economic repercussions.

To avoid these risks, you need to implement stringent payment security.

How to provide payment security for your eCommerce store

You need to be aware of multiple layers of payment security.

Choose secure and reputable payment gateways

Physical point-of-sale (POS) card-reading devices have long been established as secure payment gateways in brick-and-mortar stores. Payment gateway technologies authorize your customers’ debit and credit cards at the point of purchase, protecting transactions from unauthorized access and fraud.

And protect from fraud you must. Globally, credit card fraud cost merchants and banks over $30 billion in 2021, an increase of over 10% from the previous year. The scary thing? The United States accounted for almost half ($12 billion) of this worldwide cost.

In lieu of physical POS systems, eCommerce stores must use secure online payment gateways for card-not-present purchases. There are a few different types depending on your needs. They range from fully-hosted gateways such as PayPal, self-hosted gateways such as Stripe, and API-hosted gateways in which the entire process is handled by you directly on your website.

Secure, reputable payment gateway technologies will be enforced with defensive features such as:

- Data encryption

- 3D secure authentication

- Fraud detection and prevention

- SSL and PCI DSS compliance

Whichever payment gateways you choose, use ERP software to connect your online payment and financial data with your other back and front-end eCommerce systems. This will give you a more holistic view of the health of your business and provide you with more in-depth insight.

On top of this, disconnected payment systems silo your transaction process and increase the risk of human error. This can leave your company open to exploitable vulnerabilities and data breaches. ERP integrates payments and syncs data, maximizing security, accuracy, and reliability.

Implement SSL encryption to guarantee data confidentiality

Secure socket layer (SSL) is an encryption protocol that secures website data communications, including sensitive payment information such as card numbers and contact information.

Customers will know whether your website uses SSL (or its successor, TLS). As well as placing a lock symbol next to the URL, the URL will begin with “HTTPS” rather than “HTTP.” But if users aren’t paying attention, browsers will send an alert to warn customers that a website isn’t SSL-certified.

Image sourced from pandasecurity.com

If your customers see this message, there’s only one thing they will do—bounce.

Obtaining and installing an SSL certificate only takes a few steps. Just make sure to test and renew it to keep your website encrypted and your data secure.

Maintain PCI DSS compliance in payment processing

Closely adhere to the Payment Card Industry Data Security Standard (PCI DSS) to reliably achieve eCommerce payment security. PCI DSS is a global security standard set that dictates how businesses store, process, and transmit cardholder data.

Critical PCI DSS cybersecurity requirements include:

- Installing and regularly updating firewalls.

- Encrypting data transmissions.

- Maintaining secure, up-to-date business systems.

- Storing cardholder data in secure locations.

- Restricting who can access sensitive cardholder data using unique user identifiers.

- Using updated anti-virus and anti-malware software.

- Monitoring and tracking network access and user activity.

- Performing in-depth, continuous testing.

Businesses that aren’t PCI compliant risk not only cyberattacks and data breaches but also hefty fines of up to $100,000 per month.

Enforce strong password rules and implement 2FA for admin access

You might think that this goes without saying. And yet, a study by SpyCloud discovered that 70% of employees exposed to data breaches were reusing passwords. Even more eyebrow-raising is that Fortune 500 employees had a password reuse rate of 64%.

Data sourced from spycloud.com. Image created by writer

Enforce good password hygiene for employees and customers by specifying that passwords must:

- Be a required password length: The more characters, the better.

- Include a variety of character combinations: For example, an uppercase letter, a lowercase case letter, and a number.

- Use special characters: Symbols and special characters strengthen your passwords.

- Be changed regularly: Bonus points if the new password can’t be the same as the old passwords.

Managing passwords takes a lot of work. Suggest using secure password managers like LastPass or NordPass to make passwords more manageable to keep track of.

You should also implement two-factor authentication (2FA) or multi-factor authentication (MFA) on admin levels. These authentication methods require users to input two or more forms of identification, reducing the risk of unauthorized access.

So, as well as a password, users may have to answer a security question, authenticate themselves using biometrics, or input a one-time code sent to a registered secondary device.

Make sure your eCommerce platform and plugins are up to date

Outdated eCommerce platforms and plugins can possess critical security flaws, compromising payment security. And yet, it’s not uncommon for eCommerce businesses to procrastinate performing updates and patches.

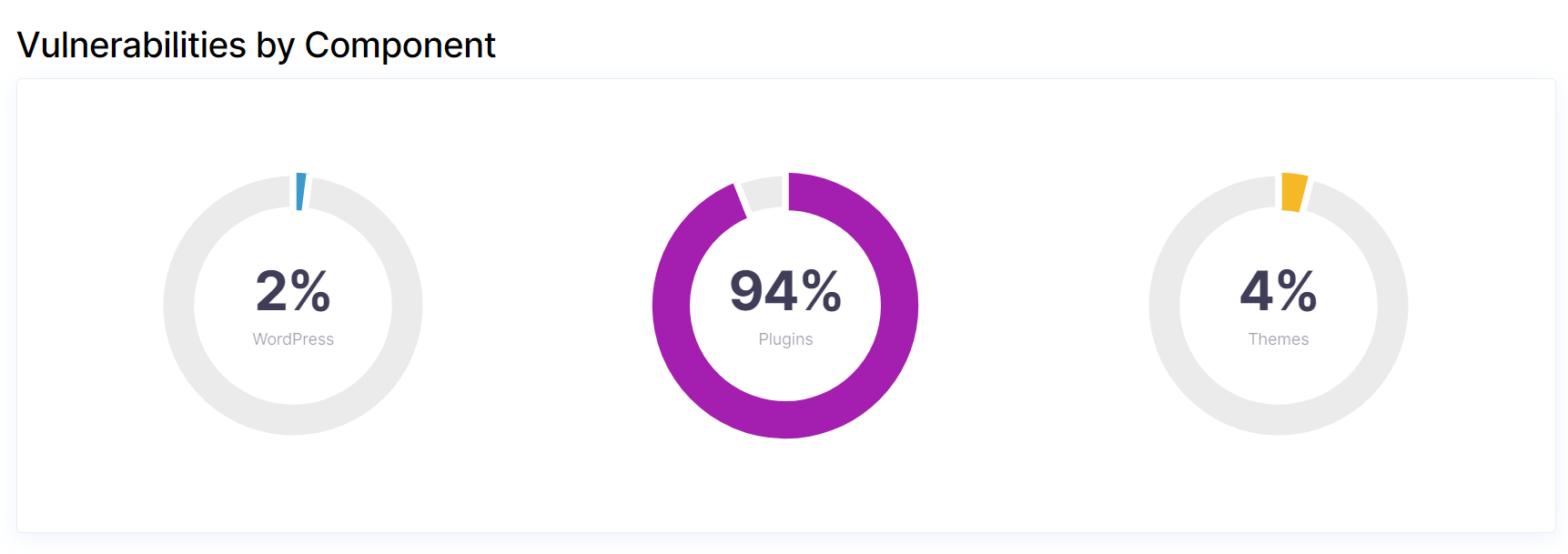

Neglecting plugin updates is a particularly common offense. However, 94% of existing WordPress vulnerabilities can be attributed to plugins alone, according to WPScan.

Image sourced from wpscan.com

If you found out there was an easy way for criminals to hack your physical security system, you’d update it, right? So, you need to do the same for your eCommerce site.

Regularly check for updates as part of your daily or weekly processes. You should also consider investing in an eCommerce website security service that can simplify your security tools and manage your plugins. This makes it easier to protect your brand and keep your customers safe.

Deploy fraud detection systems to monitor suspicious activities

Fraud detection and prevention systems use artificial intelligence, machine learning, and statistical analysis to monitor and analyze transaction activity.

A fraud detection system can analyze and extract patterns from vast volumes of historical data. This helps it intelligently differentiate fraudulent and non-fraudulent activity.

From there, it can analyze real-time customer behaviors and create individual “profiles” based on transaction patterns and behaviors. So, if it detects behavioral anomalies, it can quickly flag the transaction as a suspicious activity.

Here’s another critical reason to implement cloud ERP solutions for small businesses. As they can assist in streamlining fraud detection and prevention.

ERPs deliver full transparency, traceability, centralization, and control to your online payment data, mitigating the risk of fraud and errors. So, you can spend less time worrying about fraud and more time meeting the needs of your business.

Only gather and retain essential customer payment data

The less sensitive data you hold, the less devastating a data breach will be. Avoid collecting and keeping customer payment data you don’t need for this reason.

It’s worth noting that PCI DSS rules against storing customer credit card data unless absolutely necessary. So, never retain any card information other than the name of the cardholder and, if needed, the PAN and/or expiration date. But remember, if you don’t need it, don’t keep it.

Train your team to spot cyber threats and sensitive data handling

Your payment security processes are only as good as the team that governs them. It’s no use implementing a fancy cybersecurity system if your employees have no idea what a phishing attack is or have never heard of GDPR.

So, provide comprehensive cybersecurity and data privacy training. Cover topics such as:

- General Data Protection Regulation (GDPR) compliance.

- Threat intelligence that covers the latest cybercrime trends.

- Remote working best practices, such as VPN usage.

- The different types of cyberattacks, such as phishing and social engineering.

- The protection of removable and mobile media, such as USB sticks and SD cards, as well as smartphones and laptops.

Educate customers on secure online practices

Tackle payment security from all angles and educate customers on shopping safely and securely online. There are lots of different fun, engaging ways that you can approach this.

To give customers an interactive experience, why not host a live webinar discussing security best practices? Or, gamify the experience with a quiz or short role-playing game (complete with incentivizing rewards).

You could also write blog posts or share social media posts that discuss online security. You don’t need to be preachy or use lots of tech-savvy jargon, though. Communicate in your brand voice as you would any other time, keeping it simple, clear, and helpful.

Are your online payments secure?

There are lots of things that you can do to enhance your eCommerce store’s payment security. Ideally, you should implement as many of the above methods as possible. The more layers of protection you put in place, the harder it will be for attackers and fraudsters to exploit your system.

So, choose secure payment gateways, follow PCI DSS, deploy intelligent fraud detection systems, and make sure that employees know not to click on any suspicious-looking emails.